Marginal tax rate calculator

Ad Get the Latest Federal Tax Developments. At higher incomes many deductions and many credits are phased.

Gst Calculator How To Find Out Goods And Service Tax Tax Refund

0 would also be your average tax rate.

. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. This is 0 of your total income of 0. 2016 Marginal Tax Rates Calculator.

0 would also be your average tax rate. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. 0 would also be your average tax rate.

At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

0 would also be your average tax rate. Visit The Official Edward Jones Site. Find out your tax brackets and how much Federal and Provincial.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your marginal tax rate This calculator can also be used as an Australian tax return calculator. Personal tax calculator.

Your income puts you in the 10 tax bracket. 2020 Marginal Tax Rates Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your income puts you in the 10 tax.

Your income puts you in the 10 tax bracket. This is 0 of your total income of 0. 205 on the portion of taxable income over.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. This is 0 of your total income of 0. The Federal marginal tax rates for 2021 income earned is calculated as follows.

Your income puts you in the 10 tax bracket. Your income puts you in the 10 tax bracket. Discover Helpful Information And Resources On Taxes From AARP.

New Look At Your Financial Strategy. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax rate.

At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0. 15 on the first 49020 of taxable income Plus.

Note that it does not take into account any tax rebates or tax offsets you may be entitled to. This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased.

Marginal Tax Rate Calculator. Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Standard or itemized deduction. Your Federal taxes are estimated at 0. Your Federal taxes are estimated at 0.

Calculate your combined federal and provincial tax bill in each province and territory. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Your income puts you in the 10 tax.

Calculate the tax savings. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

0 would also be your average tax rate.

Casio Ms20ucwe Desktop 12 Digit Calculator White Desktop Calculator Casio Calculator

Factors To Determine The Best Study Loan In India Post Secondary Education Education Loan

This Article Explains The Amortization Calculation Formula With A Simple Example And A Web Based Ca Home Equity Loan Home Equity Loan Calculator Mortgage Loans

Pin On Finances Investing

Markup Calculator Omni Calculator Sales People Omni

Salary To Hourly Calculator

How Much Traffic You Need To Drive To Make At Least 1000 Per Month With Adsense Adsense Earnings Adsense Make More Money

Gross To Net Lets You See What Some Amount Would Look Like Before The Tax Is Was Applied Or After It S Been Deducted Net How To Apply Finance

Tax Calculation Spreadsheet In 2022 Spreadsheet Template Spreadsheet Excel Formula

Sales Tax Income Tax Quiz Teks 7 13a Simple Word Problems Writing Equations Math Teks

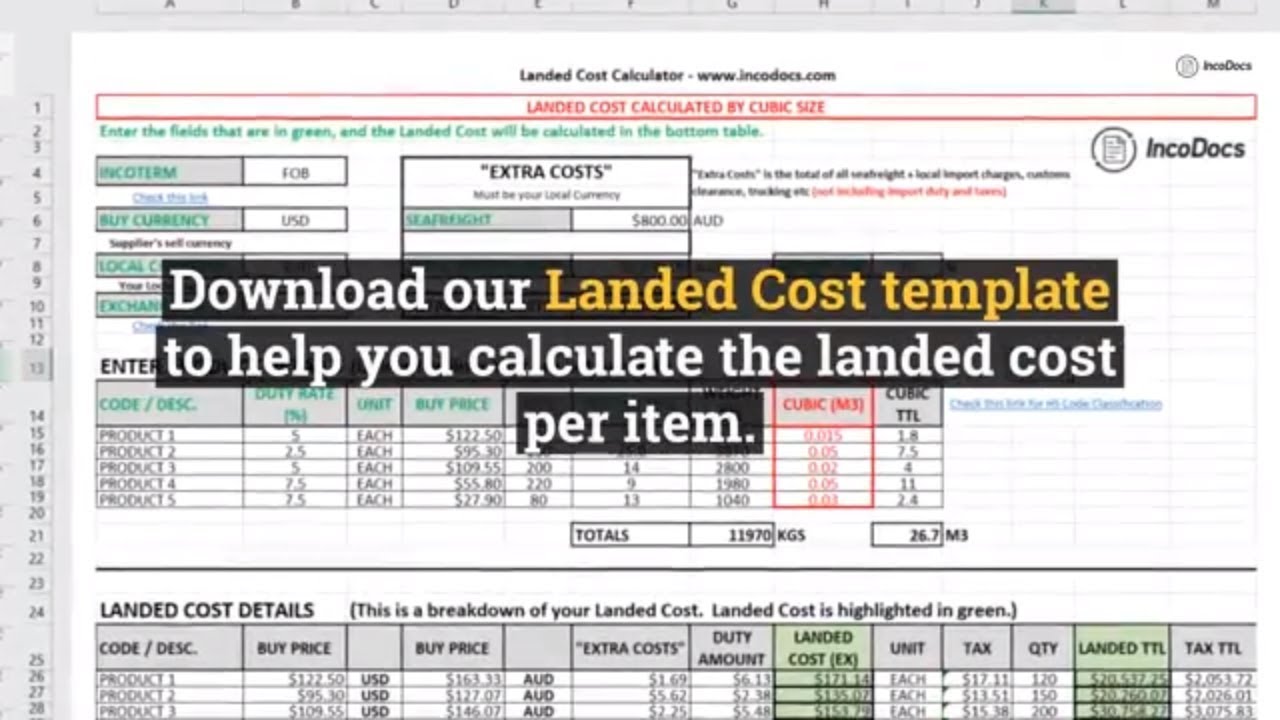

Landed Cost Template Import Export Shipping Excel Templates Price Calculator Templates

Pin On Finance

Pin On Finances Investing

Investment Property Excel Spreadsheet Rental Property Investment Property Rental Property Investment

5 Misconceptions About Gst Which Everyone Needs To Understand Understanding Goods And Services Misconceptions

Calculate Landed Cost Excel Template For Import Export Inc Freight Customs Duty And Taxes Excel Templates Excel Verb Worksheets

Percent Off Calculator Percents Calculator Finance