22+ mortgage transfer tax

This is great news because this lowers your tax amount. Web Land Transfer Tax.

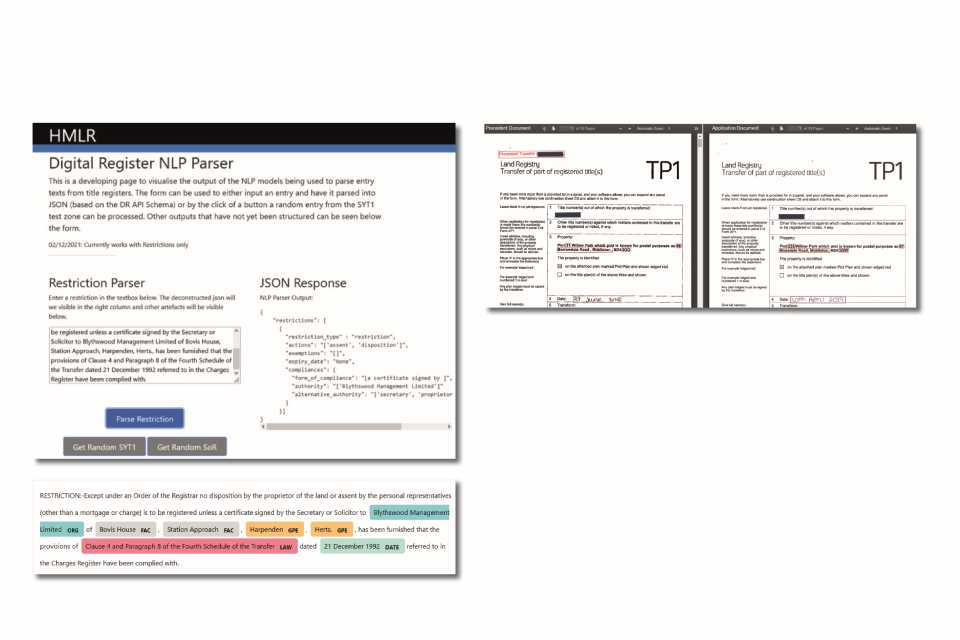

Hm Land Registry Strategy 2022 Gov Uk

Please verify your mailing address is correct prior to requesting a bill.

. Web Theres also a 327 Philadelphia Realty Transfer Tax to take care of in addition to a 1 tax from the Commonwealth. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Among last years haul 1778 million.

This is SmartAssets crash course in mortgage tax. 3 of the fair market value greater than 2000000. 2Reviews applications for exemption and determines whether the.

Lock Your Rate Today. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. The Transfer Tax is imposed on the.

You can subtract the mortgage costs from your taxable income. Web 2 of the fair market value greater than 200000 and up to and including 2000000. Ad Get Instantly Matched With Your Ideal Mortgage Lender.

If real property is. Best Mortgage Lenders in Nevada. Call us at 416-969-8130 if you need help or would like more detailed information.

Web Whenever you obtain a mortgage local governments enforce a mortgage tax to document the loan transaction. Web If you sold the property for 250000 you would divide 250000 by 500 which is 500. Apply Get Pre-Approved in 3 Minutes.

Some counties levy more. Section 40-22-3 - Tax on mortgages not applicable to any bank unless applicable to all. Web Section 40-22-2 - Mortgages deeds of trust etc generally.

Web The New York State transfer tax rate is 2 per 500 of the home price plus a 1 mansion tax for homes selling at 1 million and higher. Web Minnesotas mortgage registration tax rate is 024 in Hennepin County and Ramsey County including the 001 ERF Tax and 023 in all other Minnesota counties. Fee for the valuation of your current.

Closing costs can be as much as 3 5 of your loan amount and a big part of it can be transfer tax. Web 1Determines the amount of the tax required based on the value as represented on the Declaration of Value. Depending on where you live you may have.

Try these online tools to help make financial decisions that are right for you. Web Nevada generated more than 330 million in transfer tax revenue last fiscal year according to the Department of Taxation. 500 2 is 1000 and that would be what you owe in transfer taxes for the sale.

Web There are more costs than most people realize when you transfer real estate. Web Tax bills requested through the automated system are sent to the mailing address on record. Web 8 hours agoFirst up.

Web A transfer tax is a real estate tax usually paid at closing to facilitate the transfer of the property deed from the seller to the buyer. If the property has.

The E Invoicing Journey 2019 2025

All Taxes You Have To Pay When Buying A House Transfer Tax Mortgage Tax Co Real Estates

Personal Financial Planning For Divorce Fpa Ma November 19 Ppt Download

Burnett County Wi Lake Property For Sale Lakeplace Com

Did Rome Have High Taxes Quora

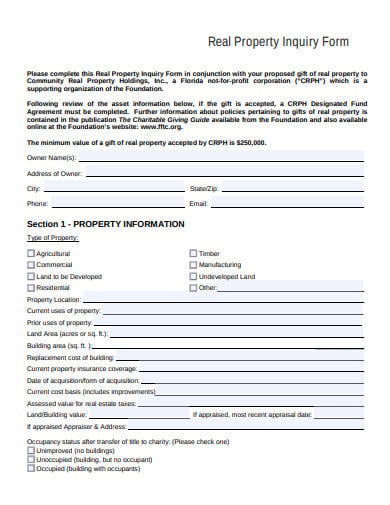

22 Property Inquiry Form Templates In Pdf Doc

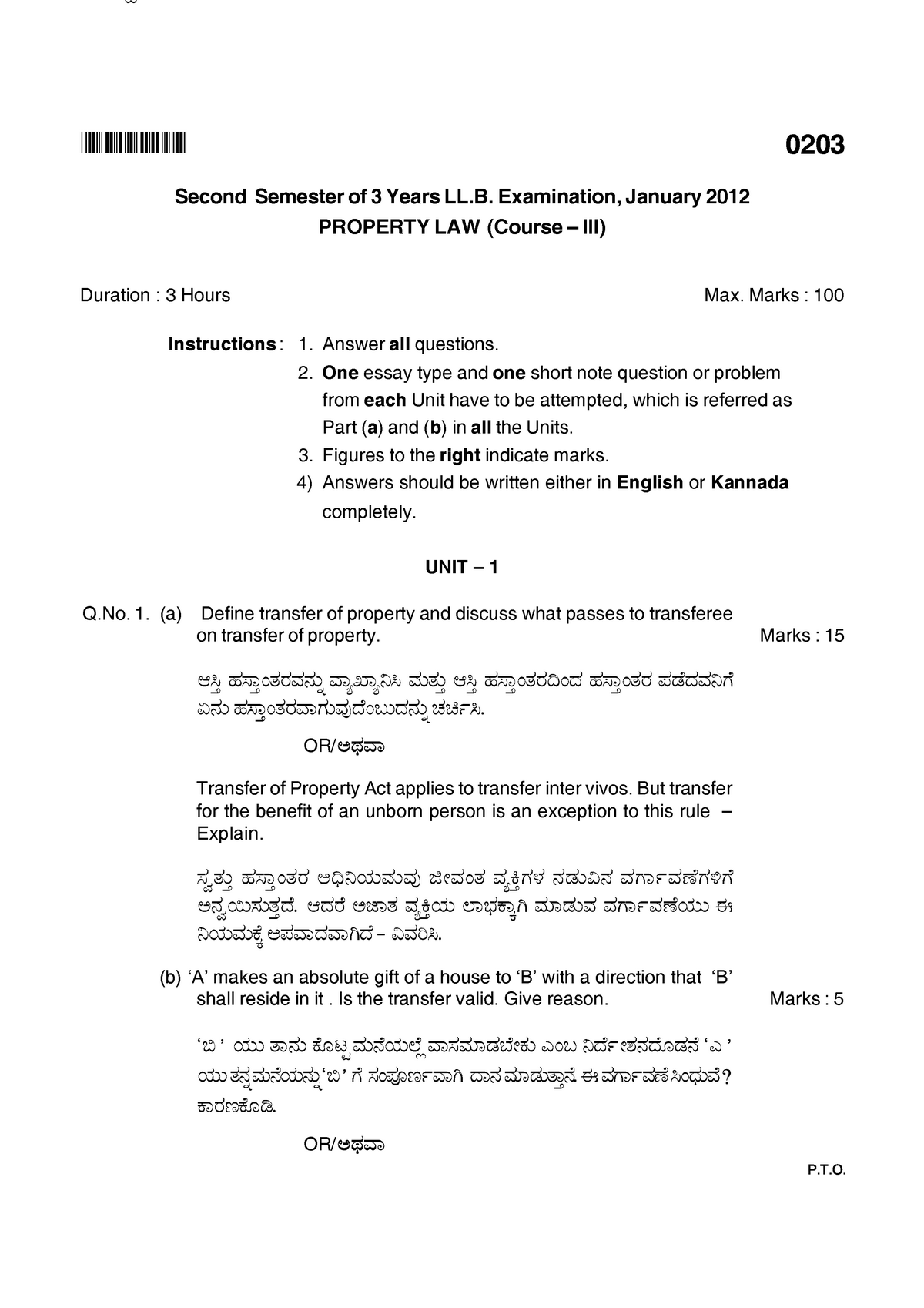

Question Papers P T Second Semester Of 3 Years Ll Examination January 201 2 Property Law Studocu

Blu Real Estate

Blu Real Estate

Calculating The Florida Intangible Tax And Transfer Tax When Buying A New Home Usda Loan Pro

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

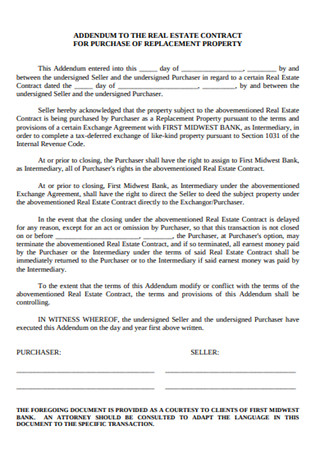

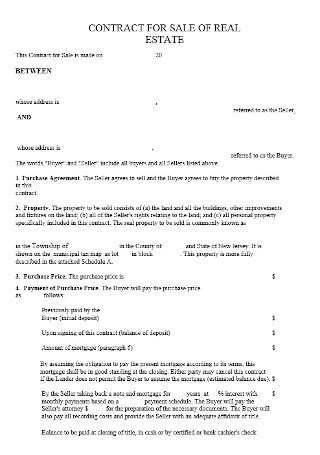

22 Sample Real Estate Contracts In Pdf Ms Word

641 Waite Road Clifton Park Ny 12065 Mls 202226326 Trulia

All Taxes You Have To Pay When Buying A House Transfer Tax Mortgage Tax Co Real Estates

Home Connolly Capital

Processing Manager Resume Samples Qwikresume

22 Sample Real Estate Contracts In Pdf Ms Word